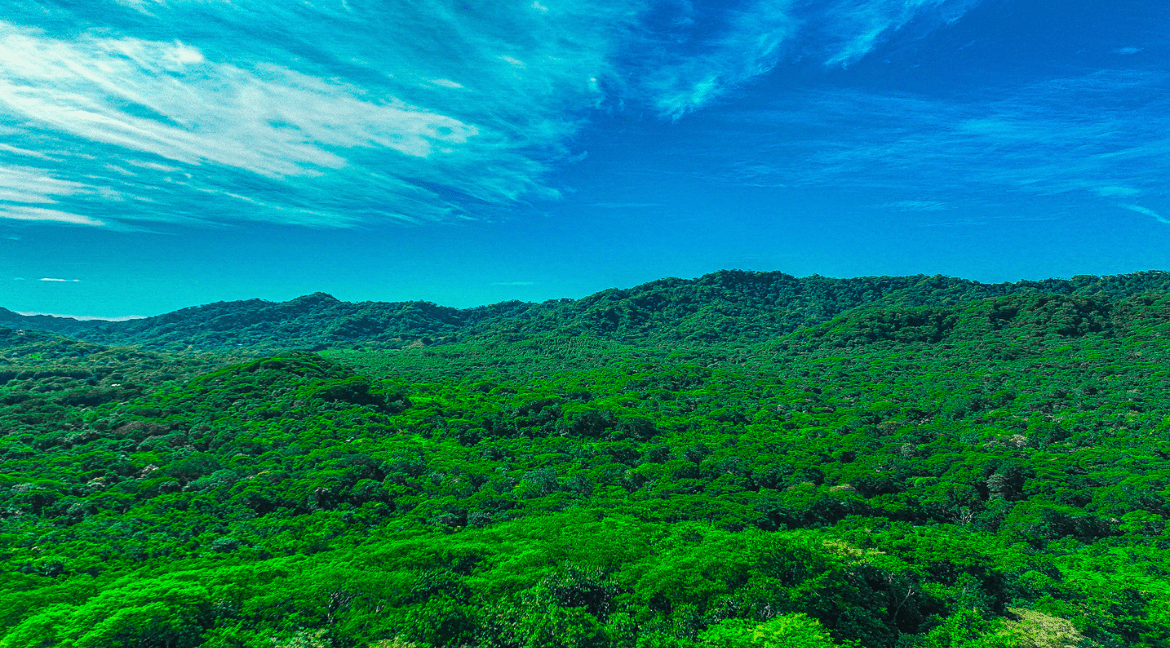

Investing in agriculture in Costa Rica is becoming an increasingly attractive option for both local and international investors. With its rich biodiversity, favorable climate, and strong commitment to sustainability, Costa Rica offers a unique opportunity to engage in farm investments. Agriculture plays a vital role in the nation’s economy, contributing significantly to employment and exports. From coffee to tropical fruits, the agricultural sector has a diverse range of products that are in high demand worldwide. This blog will delve into the benefits of investing in Costa Rican farms, types of investments available, steps to get started, potential risks, and successful case studies to help guide new investors.

Benefits of Investing in Costa Rica Farms

Investing in Costa Rican farms offers numerous benefits that attract investors. First, the country’s climate is ideal for agriculture, with consistent rainfall and fertile soil. This environment allows for year-round cultivation, maximizing production. Additionally, Costa Rica is known for its commitment to sustainable farming practices, which not only protects the environment but also appeals to consumers looking for eco-friendly products. The demand for organic and specialty crops is on the rise globally, making Costa Rica a prime location for such investments. The government’s support for agriculture, through incentives and favorable policies, further enhances the investment landscape, ensuring that investors can see a good return on their investment.

Types of Farm Investments

Costa Rica offers various types of Farm invest Costa Rica, each with its unique potential. One of the most popular options is coffee plantations, as Costa Rican coffee is renowned worldwide for its quality. Investing in organic farms is also increasingly appealing, as consumer interest in health and sustainability continues to grow. These farms often yield premium prices due to their organic certifications. Additionally, sustainable agriculture projects that focus on regenerative practices are gaining traction, providing both ecological benefits and long-term profitability. Each investment type has its own set of challenges and rewards, allowing investors to choose the option that best aligns with their goals and values.

How to Start Your Farm Investment Journey

Starting your farm investment journey in Costa Rica requires careful planning and research. First, it’s essential to understand the local agricultural landscape and market trends. This includes identifying the types of crops or livestock that are most viable in the region you’re interested in. Legal considerations are also crucial; you’ll need to navigate property ownership laws and agricultural regulations specific to Costa Rica. Finding reliable partners, such as local farmers or agricultural experts, can provide valuable insights and support. Building a network within the community can enhance your investment’s success and ensure that you are aligned with local practices and standards.

Risks and Challenges

While investing in Costa Rican farms has many advantages, it also comes with risks and challenges. Environmental factors, such as climate change and natural disasters, can impact agricultural productivity and yield. Market volatility, especially for cash crops like coffee and sugar, can lead to fluctuating prices that may affect profitability. Regulatory issues, including changes in government policies or agricultural laws, can pose additional challenges for investors. It is crucial for potential investors to conduct thorough research and risk assessments to prepare for these challenges and develop strategies to mitigate potential losses.

Success Stories

Success stories from investors in Costa Rica’s agricultural sector provide valuable lessons and inspiration. For instance, some coffee plantation owners have successfully diversified their products by incorporating agro-tourism, allowing visitors to experience coffee production firsthand while generating additional income. Others have focused on organic farming, gaining premium prices for their produce in international markets. These examples demonstrate that with the right approach, investors can thrive in Costa Rica’s agricultural landscape. Learning from these experiences can help new investors avoid common pitfalls and replicate successful strategies, ultimately leading to a profitable venture in the vibrant world of Costa Rican agriculture.

Conclusion

In summary, investing in Costa Rica’s thriving farm sector presents a unique opportunity for individuals looking to engage in sustainable agriculture while potentially reaping significant rewards. The benefits, including a favorable climate, diverse crop options, and government support, create an inviting investment environment. By understanding the various types of farm investments, navigating the necessary legal considerations, and being aware of potential risks, investors can position themselves for success. The inspiring success stories of others in the field further reinforce the potential for growth and profitability in this vibrant market. As you explore the possibilities, consider how you can contribute to and benefit from Costa Rica’s rich agricultural heritage.