Smart spending is a crucial part of achieving financial stability and long-term wealth. It involves making thoughtful decisions about where your money goes, ensuring it aligns with your goals and needs. By practicing smart spending, you can manage your resources more effectively, reduce financial stress, and build a secure future. This approach isn’t about cutting out all luxuries but rather about making informed choices that benefit your overall financial health. In today’s world, where overspending and debt are common issues, learning and applying smart spending principles can make a significant difference in your financial well-being. This article explores practical strategies and tips for mastering smart spending, helping you create a budget, set realistic goals, and avoid common pitfalls.

Understanding Smart Spending

Definition of Smart Spending

Smart spending refers to making intentional and informed choices about how you use your money. It involves prioritizing your spending based on needs, values, and long-term goals, rather than succumbing to impulse buys or unnecessary expenditures. Smart spending means evaluating each purchase and considering its impact on your overall financial plan. By focusing on what’s truly important and necessary, you can manage your finances better and avoid accumulating unnecessary debt.

Differences Between Smart Spending and Overspending

Smart spending is about making calculated decisions to maximize your financial resources, whereas overspending occurs when you spend beyond your means. Overspending often results from impulsive purchases, lack of budgeting, or not tracking expenses. It can lead to debt and financial stress, whereas smart spending helps you stay within your budget, save for the future, and achieve your financial goals. The key difference lies in control and awareness: smart spending involves thoughtful planning and intentionality, while overspending usually reflects a lack of financial discipline.

Benefits of Adopting Smart Spending Habits

Adopting smart spending habits can lead to numerous benefits. Firstly, it helps you stay within your budget, avoiding debt and financial strain. By prioritizing your spending, you can save money and build an emergency fund for unexpected expenses. Additionally, smart spending allows you to allocate resources towards long-term goals such as retirement, education, or home ownership. It also reduces financial stress and improves overall financial health, giving you more control over your money and peace of mind.

Creating a Budget

Steps to Create an Effective Budget

Creating an effective budget involves several key steps. Start by listing all sources of income, including salaries, freelance work, and any other earnings. Next, track your monthly expenses, categorizing them into fixed (rent, utilities) and variable (food, entertainment) costs. Subtract your total expenses from your income to determine if you have a surplus or deficit. Adjust your spending as needed to ensure your expenses do not exceed your income. Regularly review and update your budget to reflect any changes in your financial situation.

Importance of Tracking Income and Expenses

Tracking your income and expenses is essential for effective budgeting. It provides a clear picture of your financial situation, helping you understand where your money goes and identify areas for improvement. By keeping detailed records, you can spot spending patterns, avoid overspending, and make informed financial decisions. Tools like budgeting apps and spreadsheets can simplify this process, making it easier to monitor your finances and stay on track with your budget.

Tools and Apps to Assist with Budgeting

Several tools and apps can assist with budgeting, making it easier to manage your finances. Popular budgeting apps like Mint, YNAB (You Need A Budget), and PocketGuard offer features such as expense tracking, budget creation, and financial goal setting. These tools provide insights into your spending habits, help you categorize expenses, and alert you to overspending. By using these apps, you can streamline the budgeting process and stay organized, allowing you to focus on achieving your financial goals.

Setting Financial Goals

How to Set Achievable Financial Goals

Setting achievable financial goals starts with defining what you want to accomplish. Begin by identifying your short-term and long-term goals, such as saving for a vacation, buying a home, or retirement. Make sure your goals are specific, measurable, attainable, relevant, and time-bound (SMART). Break larger goals into smaller, manageable steps and create a plan to reach them. Regularly review your progress and adjust your plan as needed to stay on track and achieve your financial objectives.

Short-Term vs. Long-Term Goals

Financial goals can be categorized into short-term and long-term. Short-term goals are those you aim to achieve within a year, such as saving for a new gadget or paying off a small debt. Long-term goals, on the other hand, span several years or decades, like buying a house or saving for retirement. Both types of goals are important, but they require different strategies. Short-term goals often involve smaller, more immediate steps, while long-term goals necessitate consistent savings and planning over time.

Examples of Financial Goals and How to Plan for Them

Examples of financial goals include saving for an emergency fund, paying off student loans, or investing for retirement. To plan for these goals, start by determining the amount you need and the timeframe for achieving it. For instance, if you want to save $1,000 for an emergency fund in six months, set aside approximately $167 each month. Create a budget that allocates funds towards your goal and track your progress regularly. Adjust your savings plan as needed to ensure you stay on track and reach your financial objectives.

Smart Spending Strategies

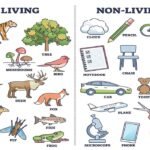

Prioritizing Needs vs. Wants

One key strategy for smart spending is distinguishing between needs and wants. Needs are essential expenses like housing, food, and healthcare, while wants are non-essential items such as luxury goods or entertainment. By prioritizing your needs and minimizing spending on wants, you can better manage your budget and allocate resources towards important financial goals. Evaluate each purchase and ask yourself if it aligns with your priorities and financial plan. This approach helps you make more intentional spending decisions and stay within your budget.

The 50/30/20 Rule Explained

The 50/30/20 rule is a popular budgeting method that divides your income into three categories: needs, wants, and savings/debt repayment. According to this rule, 50% of your income should go towards needs, 30% towards wants, and 20% towards savings and debt repayment. This simple framework helps you balance your spending and savings, ensuring that you cover essential expenses while also making room for discretionary spending and financial goals. By following this rule, you can maintain financial stability and work towards achieving your financial objectives.

Tips for Reducing Unnecessary Expenses

Reducing unnecessary expenses can help you manage your budget more effectively. Start by reviewing your spending habits and identifying areas where you can cut back. Common strategies include canceling unused subscriptions, cooking meals at home instead of dining out, and shopping for sales or discounts. Creating a shopping list before going to the store and sticking to it can also help prevent impulse purchases. By being mindful of your spending and making small adjustments, you can save money and stay on track with your budget.

Saving and Investing Wisely

Importance of Saving and Building an Emergency Fund

Saving money and building an emergency fund are crucial aspects of smart spending. An emergency fund acts as a financial cushion for unexpected expenses such as medical bills or car repairs. Aim to save three to six months’ worth of living expenses in a separate savings account to cover these emergencies. Regularly contributing to your emergency fund helps ensure you are prepared for unforeseen financial challenges and reduces the need to rely on credit or loans.

Basic Investing Principles for Beginners

Investing is an important component of building long-term wealth. Basic investing principles for beginners include understanding different types of investments, such as stocks, bonds, and mutual funds, and the risks associated with each. Diversifying your investments across various asset classes can help manage risk and maximize potential returns. Start by setting investment goals, researching different options, and considering your risk tolerance. Investing early and regularly can help you grow your wealth over time and achieve your financial objectives.

Balancing Savings and Investments with Spending

Balancing savings, investments, and spending is key to effective financial management. Allocate a portion of your income towards savings and investments while ensuring you cover your essential expenses and discretionary spending. Creating a budget that includes savings and investment goals helps you maintain this balance. Regularly review your financial plan and adjust your allocations as needed to stay on track with your goals. By finding the right balance, you can enjoy your current lifestyle while also preparing for future financial needs.

Avoiding Common Pitfalls

Common Mistakes in Budgeting and Spending

Common mistakes in budgeting and spending include failing to track expenses, setting unrealistic goals, and not adjusting the budget as circumstances change. Other pitfalls include neglecting to account for irregular expenses, such as annual insurance premiums or holiday gifts, and not planning for unexpected financial setbacks. To avoid these mistakes, regularly review and update your budget, track your spending accurately, and build flexibility into your financial plan. Being proactive and attentive to your financial habits can help you stay on track and achieve your goals.

How to Avoid Impulse Purchases

Impulse purchases can derail your budget and lead to overspending. To avoid these unplanned buys, implement strategies such as creating a shopping list and sticking to it, waiting 24 hours before making a purchase, and avoiding shopping when you’re emotional or stressed. Set spending limits for discretionary items and consider using budgeting apps that track your expenses in real-time. By being mindful of your spending triggers and practicing restraint, you can reduce impulse purchases and stay within your budget.

Strategies for Managing Debt

Managing debt effectively involves creating a plan to pay off outstanding balances and avoid accumulating more. Start by listing all your debts, including the amount owed, interest rates, and minimum payments. Prioritize high-interest debts and consider strategies such as the snowball method (paying off the smallest debt first) or the avalanche method (focusing on the highest interest rate). Make consistent payments and avoid taking on new debt. Additionally, seek professional advice if needed to develop a comprehensive debt management plan and regain control of your finances.

Conclusion

Mastering smart spending involves making intentional and informed financial decisions to achieve better financial health. By understanding the principles of smart spending, creating a budget, setting realistic goals, and avoiding common pitfalls, you can manage your money more effectively and work towards your financial objectives. Implementing strategies such as prioritizing needs, using budgeting tools, and balancing savings with spending can help you build a secure financial future. Start applying these tips today to take control of your finances and enjoy the benefits of smart spending.